Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

28 Mar, 2023

2776 Views

The recent collapse of Silicon Valley Bank (SVB) has sent shockwaves through the global financial landscape. The collapse of one of the most prominent banks serving the technology and innovation sector has investors looking for safe and stable investment options. Amid this uncertainty, investing in gold bullion has become the go-to choice for those looking to protect their wealth in a volatile market. In this article, we explore the advantages of investing in bullion should SVB fail, and why this may be an ideal time for investors to consider diversifying their portfolios.

Safety

Investors often turn to gold as a safe-haven asset during times of economic and financial turmoil. The collapse of the SVB led many to question the stability of the banking sector, which led to increased demand for gold bars. Gold has long been considered a store of value and a hedge against inflation, providing investors with a tangible asset that can help protect their wealth. Gold's appeal as a safe-haven asset is expected to increase as market uncertainty continues to mount.

Diversification

SVB's failure underscores the importance of portfolio diversification. Concentration of investments in a single industry or asset class may increase risk and potential loss. Gold bullion has a low correlation to traditional assets such as stocks and bonds, offering investors the opportunity to diversify their holdings and reduce overall portfolio risk. By adding gold bullion to their portfolios, investors can better weather market downturns and protect their wealth.

Increased physical gold demand

More investors are looking to the safety of physical gold as confidence in the banking sector wanes following the collapse of SVB. Unlike paper value or digital representations of wealth, bullion provides a tangible, finite resource that cannot be manipulated or devalued by governments or central banks. This increased demand for physical gold should support higher prices in the long-term and provide investors with attractive opportunities for capital appreciation.

Reduce counterparty risk

The failure of SVB highlights the potential risks of entrusting assets to third-party financial institutions. By investing in physical gold bars, investors can effectively reduce counterparty risk. Owning gold bars directly or storing them in private vaults removes intermediaries and ensures investors retain full control and title to their assets.

geopolitical uncertainty

In addition to the impact of the SVB collapse, ongoing geopolitical tensions and economic uncertainty continue to dominate the headlines. Gold has historically performed well during times of geopolitical turmoil, as investors seek the stability and safety it provides. As tensions escalate and the global economy faces headwinds, investing in gold can provide a valuable hedge against potential market disruption.

The Silicon Valley bank's collapse has certainly created unease among investors. However, the turmoil presents an opportunity for those looking to protect their wealth and capitalize on growing demand for safe-haven assets. Investing in gold bullion has multiple benefits, including portfolio diversification, counterparty risk reduction, and a hedge against inflation and geopolitical uncertainty. As the financial landscape continues to evolve, investing in gold may well be the golden opportunity investors need to protect and grow their wealth.

07 Apr, 2022

Gold is known as one of the most valuable investments, especially when the market is down. It is an asset that procures good returns. Also, when you wish for sc...

READ MORE

14 Mar, 2022

Gold has seen a significant increase in value over the last ten years. You can send gold jewellery or even damaged gold-plated watches or jewellery to a Preciou...

READ MORE

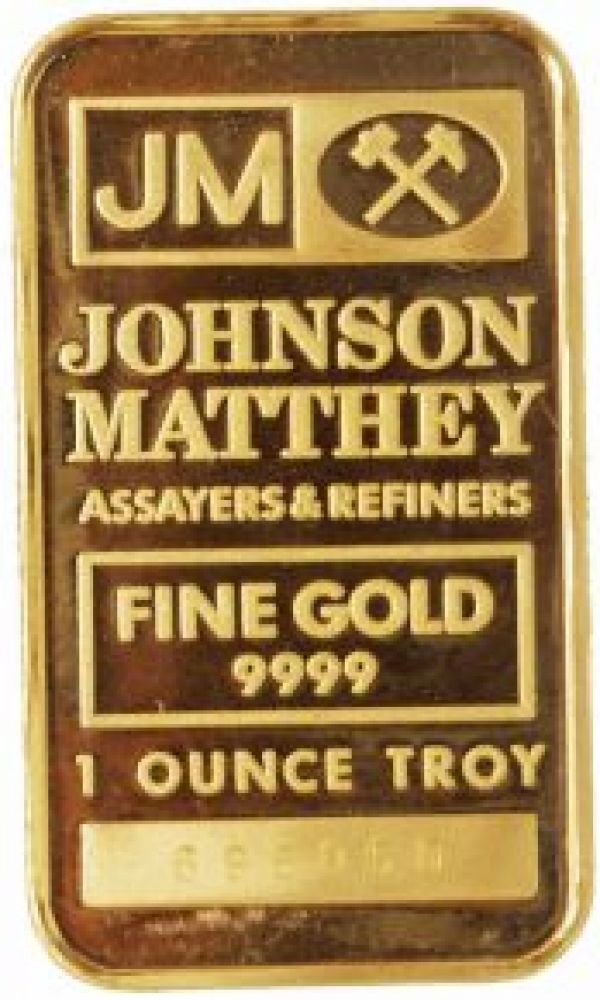

Johnson Matthey

One Ounce Gold Bar

AS LOW AS CA$1,677.09

.jpg)

Scotiabank

1 Oz Gold Coin Scotiabank

AS LOW AS CA$1,677.09

.jpg)

Royal Canadian Mint

One Ounce Gold Coin Royal Canadian Mint - Maple Leaf

AS LOW AS CA$1,677.09

.jpg)

Johnson Matthey

1 Oz Gold Bar Johnson Matthey

AS LOW AS CA$1,677.09

Business Hours: Monday to Friday: 8:30 AM to 5:00 PM