Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

12 Sep, 2022

1939 Views

With the global economic backdrop of a post-pandemic and the Ukrainian war, governments borrow money to stimulate the economy, causing many investors to worry about the stock market.

When such an event occurs, investors become reactionary and buy more gold. Gold retains its value during times of economic uncertainty. However, what ended up happening is that most investors only pay attention to the metal when it gets more media attention.

Of course, when it's in the news, it means a lot volatility occurs. Many people ask the question more frequently today: Is the right time to invest in Gold?

The answer is that there is no "right time" because gold is a continuously traded metal. "I always advise our clients to buy it and average your purchases over time. That's always the best strategy that I found t be the right one. You don't go in all at once and come out all at once. it must be a continuous buy or sell approach. " Fortunately, gold prices are levelling off in the long run. It's not surging like cryptocurrencies Gold's value rises when the dollar falls, which also makes it more attractive when the dollar falls.

The value of money is unpredictable. Gold is considered relatively inflationary and deflationary, holding even appreciation in times of economic inflation and deflation. This is because unlike Fiat currency, gold is a limited commodity. Gold supply is actually falling. sell gold As Canadian investors, funds are converted into US dollars, so in Canada, we face two different factors, exchange rate and gold price volatility.

Fortunately, we are a seller and wholesaler who buys precious metals directly from the refineries and then sells directly to our investors. So our investors are skipping all other gains dealers can intervene. Gold investing should be part of a diversified portfolio for a number of reasons.

07 Apr, 2022

Gold is known as one of the most valuable investments, especially when the market is down. It is an asset that procures good returns. Also, when you wish for sc...

READ MORE

14 Mar, 2022

Gold has seen a significant increase in value over the last ten years. You can send gold jewellery or even damaged gold-plated watches or jewellery to a Preciou...

READ MORE

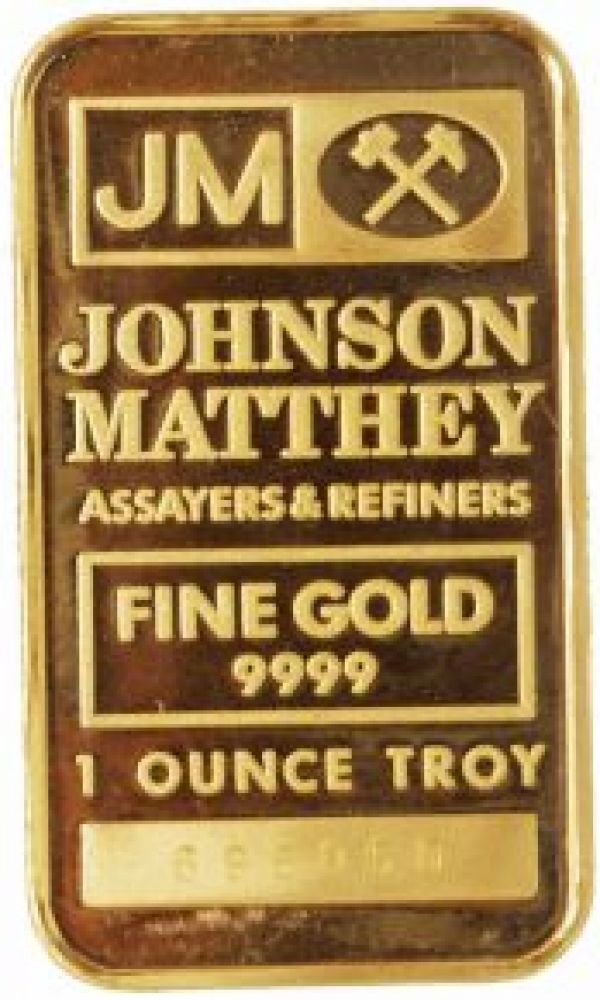

Johnson Matthey

One Ounce Gold Bar

AS LOW AS CA$1,677.09

.jpg)

Scotiabank

1 Oz Gold Coin Scotiabank

AS LOW AS CA$1,677.09

.jpg)

Royal Canadian Mint

One Ounce Gold Coin Royal Canadian Mint - Maple Leaf

AS LOW AS CA$1,677.09

.jpg)

Johnson Matthey

1 Oz Gold Bar Johnson Matthey

AS LOW AS CA$1,677.09

Business Hours: Monday to Friday: 8:30 AM to 5:00 PM