Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

05 Feb, 2023

1884 Views

"I'm not bearish on gold right now, but if I get a sell signal, I think the next step is down to the $1,500 level, which is the ultimate buying area," he told Canadian Jeweller magazine. "I think that's going to be your opportunity to really get into gold long-term. And then I think gold will eventually break out to new all-time highs."

Gold is a precious metal that has been used as a store of value for thousands of years. It is widely considered a safe haven as it maintains its value during times of economic uncertainty and market volatility.

Gold prices have risen sharply in recent years due to a combination of low interest rates, quantitative easing and increased demand from investors looking to hedge against inflation and market risks. On February 2, 2023, the price of gold is around $1,935.40/oz.

There is always the possibility of a pullback in gold prices. While it is difficult to predict the exact timing and magnitude of a market correction, some potential factors that could lead to lower gold prices include:

Rising interest rates: When interest rates rise, the opportunity cost of holding gold that does not generate an income stream increases. As a result, investors are more likely to shift their investments away from gold and towards other assets with higher yields.

Improving economic conditions: As the global economy continues to recover and grow, investors are unlikely to seek out safe-haven assets such as gold. This could lead to lower demand for gold and thus lower gold prices.

Increased gold supply: A significant increase in gold supply could weigh on gold prices. This can happen if new gold deposits are discovered and developed, or if existing gold mines are able to increase production.

Lower Geopolitical Risks: If tensions between major powers ease and geopolitical risks lower, demand for gold as a safe haven could fall, which would lead to lower prices.

While there is always the potential for gold prices to fall, it is important to remember that gold has historically been a long-term resilient asset. Despite short-term price fluctuations, gold retains its value over time and has been a reliable store of value for centuries.

To sum up, although there is a possibility that the gold price may pull back, it is difficult to predict the timing and magnitude of this pullback. Investors should consider their investment objectives, risk tolerance and investment horizon when deciding whether to add gold to their investment portfolio. As with any investment, it is important to do your due diligence and consult a financial advisor before making any investment decision.

#GoldPrices #GoldRally #GoldPullback #GoldInvestment #GoldSafeHaven #GoldPriceFactors #GoldStoreOfValue #GoldMarket #GoldPriceFluctuations #GoldResilience #GoldInvestmentObjectives #GoldRiskTolerance #InvestmentHorizon #GoldDueDiligence #FinancialAdvisor #InvestmentDecision #GoldRecovery #GoldGrowth #GoldDeposits #GoldMines #GeopoliticalRisks #GoldInvestmentPortfolio #GoldAsset #GoldDemand #GoldValue #GoldCenturies

07 Apr, 2022

Gold is known as one of the most valuable investments, especially when the market is down. It is an asset that procures good returns. Also, when you wish for sc...

READ MORE

14 Mar, 2022

Gold has seen a significant increase in value over the last ten years. You can send gold jewellery or even damaged gold-plated watches or jewellery to a Preciou...

READ MORE

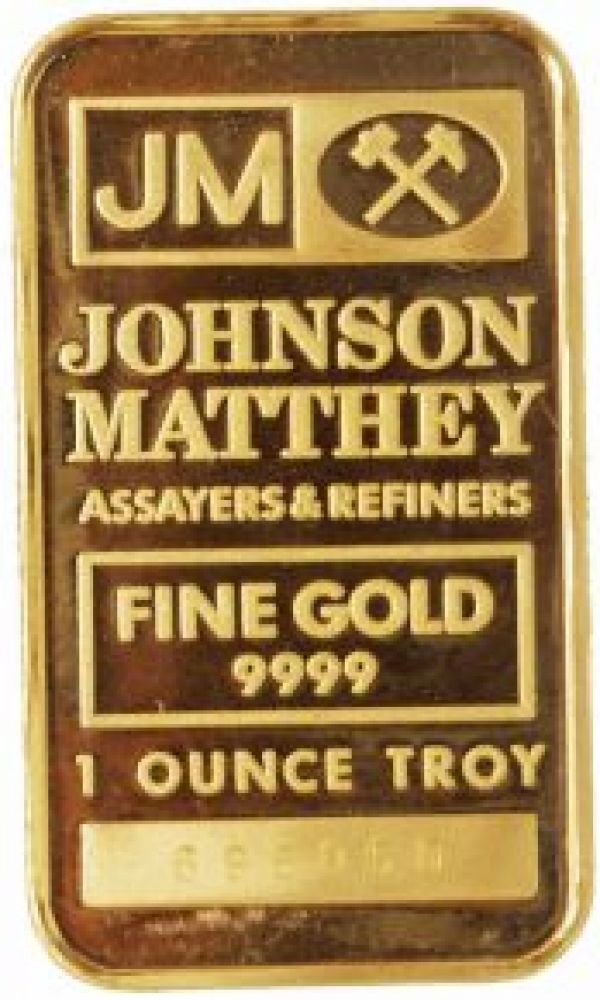

Johnson Matthey

One Ounce Gold Bar

AS LOW AS CA$1,677.09

.jpg)

Scotiabank

1 Oz Gold Coin Scotiabank

AS LOW AS CA$1,677.09

.jpg)

Royal Canadian Mint

One Ounce Gold Coin Royal Canadian Mint - Maple Leaf

AS LOW AS CA$1,677.09

.jpg)

Johnson Matthey

1 Oz Gold Bar Johnson Matthey

AS LOW AS CA$1,677.09

Business Hours: Monday to Friday: 8:30 AM to 5:00 PM