Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

23 Jan, 2023

2034 Views

Gold price peaked at US $2,074.60 on March 8, 2022.

Gold's first break above the significant price level of US $2,000 in mid-2020 was undoubtedly due mainly to the economic uncertainty caused by the COVID-19 pandemic. To break through that barrier and hit a new all-time high, gold has rallied more than US $500, or 32%, in the first eight months of 2020.

Gold recently hit record highs as Russia's invasion of Ukraine collided with rising global inflation, boosting the appeal of the safe-haven asset.

Despite this recent situation, gold has had its ups and downs over the past decade. After the metal peaked at US $1,920 an ounce in late 2011, prices fell sharply in mid-2013, falling to around US $1,220. From 2014 to early 2019, it stayed between US $1,100 and US $1,300. However, in the second half of 2019, a weaker US. dollar, heightened geopolitical concerns and slower economic growth pushed gold above US $1,500.

Gold price action in 2021 has disappointed many market watchers hoping for further gains compared to 2020. Gold's failure to do such surprised investors and commentators alike.

The outlook for gold in 2022 was initially much brighter, but prices have fallen since hitting record highs in March. It fell below the US $1,700 mark despite a brief rally during the summer months.

When will gold resume its uptrend? Only time will tell, but seasoned gold investors view this downturn in the gold market as a buying opportunity rather than a cause for concern.

Gareth Soloway, chief market strategist at InTheMoneyStocks.com, advised investors not to get carried away by recent factors driving gold prices higher.

"If you're a long-term gold investor, you just need to focus on the fact that they're printing money and that China is going the digital renminbi route - they want the digital renminbi to be the new global reserve currency, which ultimately puts downward pressure on the US dollar." Solow "The US dollar -- which is also inflationary -- is good for gold," Way explained. "All of these things that will play out over the next two years, five years, ten years are going to and should be driving gold higher."

Like other metals, the spot price of gold is affected by supply and demand dynamics.

China and India are the largest buyers of physical gold and are in an ongoing scramble to become the world's largest gold consumers. However, central bank purchases rebounded in 2021 after falling to decade lows during the pandemic in 2020. Central bank watchers expect net gold purchases to continue into 2023.

Higher investment demand for gold typically translates into higher demand for gold-based mutual funds and gold-mining stocks

From the perspective of supply, the top five gold-producing countries in the world in 2021 are China, Australia, Russia, the United States and Canada. The consensus in the gold market is that significant miners have underinvested in gold exploration in recent years. Gold mine production has stagnated at around 3,200 to 3,300 tonnes per year for the past five years.

#goldprice #historicalgoldprice #goldmarket #goldinvestment #goldminingstocks #goldexploration #goldproduction

07 Apr, 2022

Gold is known as one of the most valuable investments, especially when the market is down. It is an asset that procures good returns. Also, when you wish for sc...

READ MORE

14 Mar, 2022

Gold has seen a significant increase in value over the last ten years. You can send gold jewellery or even damaged gold-plated watches or jewellery to a Preciou...

READ MORE

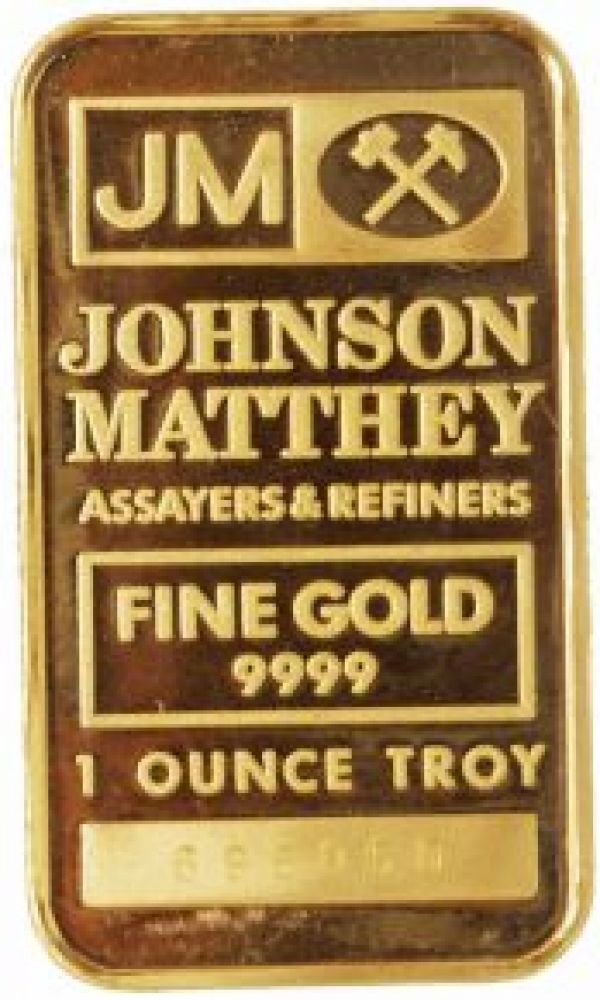

Johnson Matthey

One Ounce Gold Bar

AS LOW AS CA$1,677.09

.jpg)

Scotiabank

1 Oz Gold Coin Scotiabank

AS LOW AS CA$1,677.09

.jpg)

Royal Canadian Mint

One Ounce Gold Coin Royal Canadian Mint - Maple Leaf

AS LOW AS CA$1,677.09

.jpg)

Johnson Matthey

1 Oz Gold Bar Johnson Matthey

AS LOW AS CA$1,677.09

Business Hours: Monday to Friday: 8:30 AM to 5:00 PM