Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

05 Feb, 2023

1973 Views

What is a Gold ETF (Exchange Traded Fund)?

EFT stands for Exchange Traded Fund and is a security that tracks an index, commodity, or basket of assets such as stocks and bonds. ETFs can be traded like stocks on a stock exchange. There are many types of ETFs, but the most common are stock ETFs, which hold shares in different companies.

Why Invest in Gold ETFs?

Gold ETFs are a convenient way to invest in gold because they provide liquidity and diversification. Liquidity means you can buy and sell shares of a gold ETF like any other stock on an exchange. This helps to enter and exit the market as needed.

Diversification is another great benefit of investing in gold ETFs. A diversified stock portfolio reduces your exposure to one company or asset class.

Pros and Cons of Gold ETFs

The great thing about investing in gold ETFs is that it's very easy. You can buy and sell shares of a gold ETF just like any other stock, and you don't have to worry about storing them. However, there are some potential downsides to investing in gold ETFs. For one thing, the price of gold can be more volatile than the price of stocks or other investments. Additionally, the value of a gold ETF may not reflect the price of physical gold as accurately as you would like.

Gold prices can be unpredictable and can fluctuate greatly over short periods of time, leading to potential losses for investors.

Gold ETFs may not be as easily tradable as other financial instruments, making it more difficult for investors to quickly sell their holdings in response to market changes or personal needs.

ETFs are subject to counterparty risk, which is the risk that the issuer of the ETF will not be able to fulfill its obligations to the investor.

Gold ETFs typically charge management fees, which can reduce an investor's overall returns.

Market risk: Like all investments, gold ETFs are subject to market risk and can decline in value along with the overall stock market

Advantages of gold bars vs ETF

When it comes to investing in gold, there are several options. You can buy physical gold in the form of coins or bars, or invest in ETFs.

Each option has its own advantages and disadvantages, and it is important to weigh all options before making a decision. Let's take a closer look at the pros and cons of investing in gold bullion.

Advantage:

1. Gold bars are physical assets that you can hold in your hands.

2. Easy to store and transport.

3. They provide liquidity, which means you can sell them at any time.

4. They provide diversification, which means they can reduce your risk if you have other investments.

5. They come in different sizes so you can choose the one that best suits your needs. They can be more expensive than other forms of investment.

Why is it smart to invest in precious metals?

ETFs are tied to stocks, which means their value can rise or fall with the market. Gold bars, on the other hand, are a physical commodity that always has value. It doesn't matter what the stock market is doing; the price of gold is always determined by its value.

Another reason to invest in gold bullion is that it is a safe investment. Gold has been used as currency and jewelry for thousands of years, so it's unlikely to lose value anytime soon. In fact, many experts believe that gold prices will continue to rise in the coming years.

So if you are looking for a safe and stable investment option, gold is a wise choice.

Plus, it helps you diversify your portfolio and reduce the overall risk of your investments. This is especially important during times of economic uncertainty.

Precious metals are finite resources, which means only finite quantities are available. This scarcity drives up their value, making them a worthwhile long-term investment. Remember, the demand for precious metals is not limited to one country, but a global phenomenon. This makes the precious metals market more stable and less vulnerable to regional economic downturns.

Finally, unlike stocks, bonds or other investments and ETFs, precious metals are tangible assets that can be physically held. That makes them a safe investment during a market crash or other financial crisis.

#GoldETF

#GoldBullion

#Investing

#Diversification

#Liquidity

#PhysicalAsset

#MarketRisk

#CounterpartyRisk

#ManagementFees

#PreciousMetals

#SafeInvestment

#StableInvestment

#EconomicUncertainty

#FiniteResources

#LongTermInvestment

#GlobalPhenomenon

#StableMarket

#TangibleAssets

#MarketCrash

#FinancialCrisis

#PortfolioDiversification

#GoldPrices

#EconomicDownturns

#WiseChoice

#GoldInvesting

07 Apr, 2022

Gold is known as one of the most valuable investments, especially when the market is down. It is an asset that procures good returns. Also, when you wish for sc...

READ MORE

14 Mar, 2022

Gold has seen a significant increase in value over the last ten years. You can send gold jewellery or even damaged gold-plated watches or jewellery to a Preciou...

READ MORE

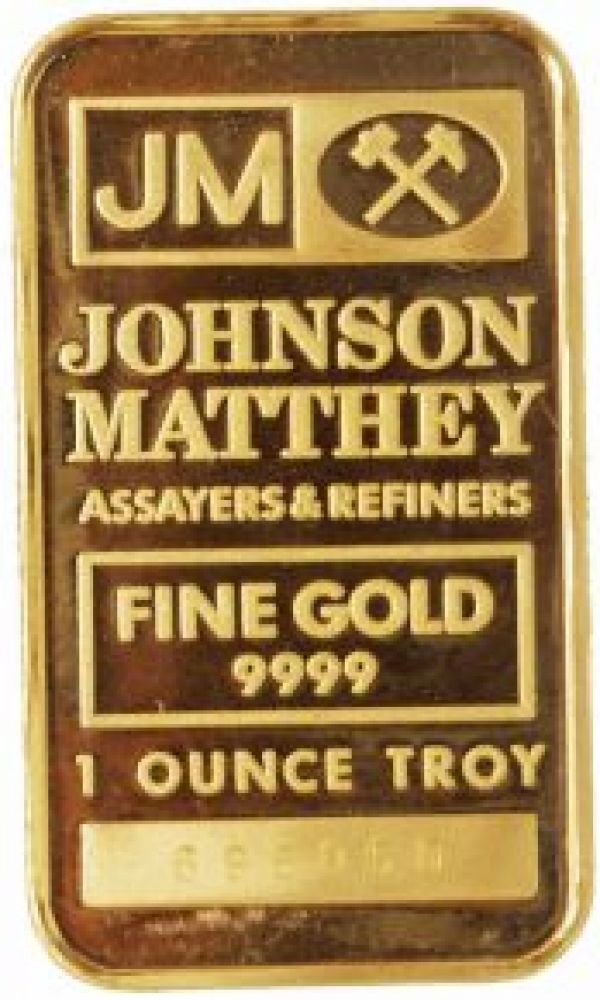

Johnson Matthey

One Ounce Gold Bar

AS LOW AS CA$1,677.09

.jpg)

Scotiabank

1 Oz Gold Coin Scotiabank

AS LOW AS CA$1,677.09

.jpg)

Royal Canadian Mint

One Ounce Gold Coin Royal Canadian Mint - Maple Leaf

AS LOW AS CA$1,677.09

.jpg)

Johnson Matthey

1 Oz Gold Bar Johnson Matthey

AS LOW AS CA$1,677.09

Business Hours: Monday to Friday: 8:30 AM to 5:00 PM