Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Gold - Ask : $ 1286.18 / Bid : $ 1285.41 (0.50)

Silver - Ask : $ 17.033 / Bid : $ 17.026 (0.03)

Platinum - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

Palladium - Ask : $ 939.8 / Bid : $ 935.5 (-1.30)

23 Jan, 2023

1845 Views

Silver's biggest one-month gain in nearly two years led to net profit-taking by investors for the first time since the Russian invasion of Ukraine triggered a price spike in March.

It was also the first time customers outnumbered precious metal buyers since June 2016, when the shock of the Brexit referendum sent prices up more than 14 percent.

Buying the dip and taking advantage of a surge in precious metals really depends on how you approach the market.

Trading gold, silver, platinum or palladium when prices are falling or rising is feasible and increasingly attractive when you discount double-digit trade spreads.

That’s why the number of silver sellers on several platforms last month was 39.6% higher than October’s figure, the highest since March.

By contrast, buyers fell 41.1% last month in response to surging silver prices, the biggest drop since May 2013 and the smallest drop since May 2019.

Overall, the Silver Investor Index -- a unique measure of the precious metal's discretionary decision-making -- saw its biggest drop since October 2020, falling 4.5 points to 49.0.

A reading above 50.0 indicates a perfect balance between the number of buyers and those deciding to sell. November 2022 is the first reading below 50 since June 2016.

As the precious metal surged in November, the gold investor index also fell, the sharpest drop since last summer, when the dollar price of gold posted its biggest monthly gain in 18 months.

Gold bullion ended November up 7.0% from the start of the year as the U.S. dollar retreated from its 2022 foreign exchange surge.

It was gold's most substantial gain since May 2021, with prices also up 3.7% monthly.

In response, the number of bullion buyers fell 27.0% from October, almost the most significant drop in the past 18 months. On the other hand, the number of sellers increased by 27.2%, the largest increase since February.

Overall, the Gold Investors Index, a unique gauge of gold holders' behaviour, posted its most significant drop since July 2021, falling 3.2 points to 53.5, the lowest reading in nine months.

Likewise, a reading above 50.0 indicates a perfect balance between the number of buyers and those deciding to sell.

Meanwhile, silver inventories fell 0.4%, the first net outflow in eight months, with customers selling 5.3 tonnes from a record high of 1,267.3 tonnes in late October.

What to expect?

Rising interest rates have limited demand and prices for the precious metal this year, offsetting inflation and geopolitical impacts. But consumer demand has recovered, and stagflation in 2023 could cause central bankers to lose the nerve to raise rates more aggressively.

Gold jewellery demand has now returned to pre-pandemic levels, but prices have risen by $500. Silver's long-term fundamentals continue to improve as rising demand, especially from green energy technologies, is offset by weak or stagnant mine supply.

The market's current levels mask massive price action in 2022, leaving the precious metal flat since the new year, even as gold hit a new all-time high following Russia's invasion of Ukraine and silver rallied 30% from bottom to bottom.

The recovery in gold and silver is now outpacing itself as a short covering by "hot money" traders in Comex futures and options has pushed prices up so fast that physical buyers are now unable to follow the market higher, making for more active investing Those who can make a quick profit.

If you would like to learn more about our services and how we can help you with your bullion needs, we would be happy to set up a free consultation with you.

#silverprofit #silverbullion #preciousmetal #shortcovering #Comexfutures #optionsbets #investors #Russia #Ukraine #Brexit #buyingthedip #preciousmetalsmarket #gold #platinum #palladium #tradespreads #SilverInvestorIndex #GoldInvestorsIndex #stagflation #centralbankers #greenenergy #minesupply #shortcovering #hotmoneytraders #physicalbuyers #activeinvesting

07 Apr, 2022

Gold is known as one of the most valuable investments, especially when the market is down. It is an asset that procures good returns. Also, when you wish for sc...

READ MORE

14 Mar, 2022

Gold has seen a significant increase in value over the last ten years. You can send gold jewellery or even damaged gold-plated watches or jewellery to a Preciou...

READ MORE

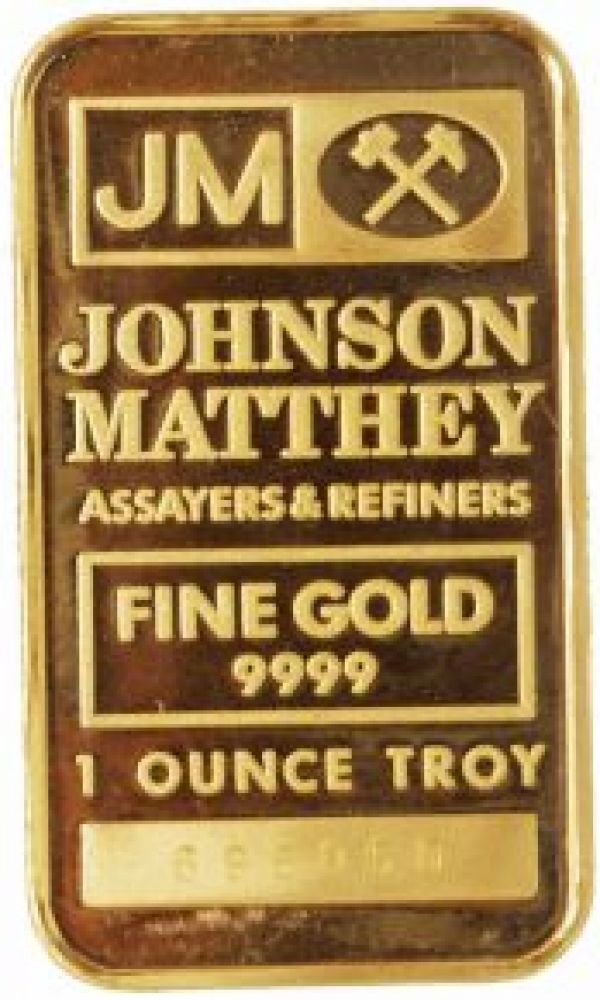

Johnson Matthey

One Ounce Gold Bar

AS LOW AS CA$1,677.09

.jpg)

Scotiabank

1 Oz Gold Coin Scotiabank

AS LOW AS CA$1,677.09

.jpg)

Royal Canadian Mint

One Ounce Gold Coin Royal Canadian Mint - Maple Leaf

AS LOW AS CA$1,677.09

.jpg)

Johnson Matthey

1 Oz Gold Bar Johnson Matthey

AS LOW AS CA$1,677.09

Business Hours: Monday to Friday: 8:30 AM to 5:00 PM